The payment settlement is the process through which the merchant finally gets paid for the goods and services sold online. It is one of the critical stages in a payment gateway system.

Table of Contents

How the Payment Settlement Process Works:

Once a customer has purchased a product/service and made the payment, the amount is charged to the customer’s bank account. If a customer makes the payment using a card, the amount gets moved from the customer’s bank account to the acquiring bank (merchant bank account), completing the transaction. That’s the simple definition of the payment settlement process; however, there are many steps involved.

Let’s look at the various steps involved in a payment settlement process:

- Client Creates the Order: Once a client has chosen a product and filled all of the requisite information on the payment page, an order ID is created.

- Payment Details are Sent: Payment details are sent once the customer has chosen a mode of payment.

- The Direction of Funds: The amount is deducted from the customer’s account and moved to the seller’s merchant account, which is separate from the business account. The money remains parked there till the end of the settlement period to facilitate any refunds or chargebacks on the purchase.

- Settlement Process: The settlement period takes around 2-3 days once the transaction has been completed. The funds are moved from the merchant account to the business account of the seller, thus completing the transaction.

One of the most important assets in a payment settlement process is the merchant account, without which the online seller can’t function if they want to accept and process online payments.

What is a Merchant Account?

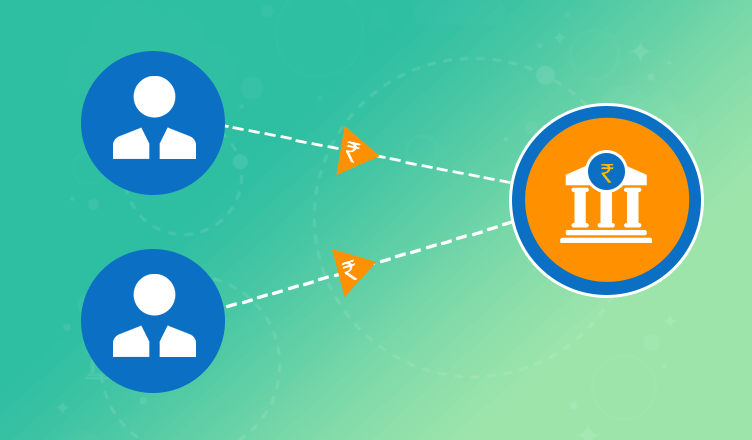

A merchant account is different from a business account. It acts as an intermediary between the customer’s account and the seller’s business bank account while accepting and processing online payments.

It’s responsible for withdrawing funds from the customer’s account and depositing that amount into the seller’s checking account. The amount that the customer has paid for a product/service is held in the merchant account for a specified period known as the settlement period to facilitate any refunds or chargebacks.

Once this settlement period is over, the amount gets transferred from the merchant account to the seller’s business account, and the transaction is deemed complete.

Also, Check – Who is Jaycee Shakur

Types of Merchant Accounts:

There are multiple types of merchant accounts you can go in for depending on your business. Listed below are the three types of merchant accounts available for business owners!

- Retail: This is a type of merchant account explicitly designed for retail establishments with fixed store locations. This type of merchant account usually comes with low setup and transaction fees.

- Mobile Merchant: if you are in the event, food truck, or any other type of business that does not come with a fixed location, you will need this type of account to accept and process credit card payments.

- E-Commerce: If you own an online store, you need a merchant account specifically designed to serve your business. The setup and transaction fee for such an account could vary as per the transaction volume and scope of business.

Now that you know what a settlement process is and how it works, along with the importance that a merchant account plays in the entire process and the types of merchant accounts available to you.

We hope that there isn’t much that has been left unanswered. They are both crucial aspects of a payment gateway system, and therefore, it’s essential to have some level of understanding about the two.

We hope that now that you understand, you will be better able to understand the inner workings of a payment gateway system!